Should You Downsize Your Home at Retirement?

As you approach retirement, one of the most impactful decisions you’ll make is choosing the right living arrangement. For current homeowners, that often means asking: Should I stay where I am, or is it time to downsize?

Some retirees choose to age in place, while others see the benefits of moving to a smaller home or a well-appointed retirement community. Like most decisions in retirement, there’s no one-size-fits-all answer—but we can help you weigh the pros and cons so you can decide if downsizing is the right move for you.

Benefits of Downsizing in Retirement

1. Lower Housing Costs

Downsizing typically reduces your monthly expenses. Smaller homes usually come with:

- Lower mortgage payments (or no mortgage at all if your other home sale covers the full cost)

- Reduced property taxes and insurance

- Less money spent on utilities and maintenance

If you choose to move into a retirement community, you could save even more. Many communities roll services like landscaping, fitness access, and even dining into one monthly fee—removing the hassle and hidden costs of homeownership.

2. Less Maintenance and Fewer Responsibilities

With a smaller home or a Continuing Care Retirement Community, you'll have less to clean, fewer repairs to manage, and no more snow shoveling or yard work. Many communities handle all this for you and some even include in-home repairs and 24/7 emergency support.

3. Increased Convenience and Comfort

Retirement is the perfect time to simplify. Downsizing might mean fewer stairs, closer access to shops or medical care, and a layout that works better for your lifestyle now. And if you move into a community, everything from fitness classes to book clubs might be right on-site.

4. A Fresh Start

Sometimes a fresh start is exactly what you need. Maybe it’s moving closer to family, relocating to a warmer climate, or just switching things up after decades in the same place. Downsizing gives you the chance to create a home that reflects where you are now in life.

Disadvantages of Downsizing in Retirement

1. Less Space

Fewer rooms mean less space for guests, storage, or hobbies that need a bit more room. If you regularly host holidays or still have lots of stuff you’re not ready to part with, this can be tricky.

2. Less Privacy

Smaller homes or apartment-style communities might not offer the same level of personal space. That said, many people find the trade-off worth it for the sense of community and ease of living.

3. Less Flexibility

A smaller home might not work as well if your situation changes, like needing to care for a loved one or if your health needs shift. That’s one reason many people opt for communities designed with aging in mind, where care can scale with your needs.

4. Emotional Ties

Letting go of a longtime home is hard. Your house probably holds a lot of memories, and that can make it tough to leave, even if moving makes sense. But just remember, you’re not leaving the memories behind. You’re just creating room for new ones.

5 Things to Think About Before You Decide Whether to Downsize in Retirement

1. Financial Situation

Can you comfortably afford to stay where you are? Would selling your home give you a financial cushion or ease monthly expenses? Even if the mortgage is paid off, things like property taxes, utilities, and repairs can really add up.

2. Lifestyle

Do you actually use all the space in your current home? Could you live just as happily, or even more happily, with less? Would moving open the door to a hobby or lifestyle you’ve been dreaming about?

3. Health

Can you handle the stairs, yard work, and upkeep? Or would a smaller space, or a place designed for aging adults like a CCRC, make daily life easier and safer?

4. Emotional Attachment

How strongly are you emotionally tied to your current home? And are you ready to let go of the physical space in exchange for more comfort, convenience, or freedom?

5. Family Members

Would downsizing bring you closer to loved ones, or farther away? Either could be a deal maker or breaker depending on your priorities.

Considerations for Downsizing in Retirement

The decision of whether you should downsize your home at retirement depends on your individual circumstances. It’s important to weigh the pros and cons of downsizing in retirement carefully and make a decision that is right for you.

Here are some individual factors to consider:

1. Financial Situation

Your financial stability plays a crucial role in the decision to downsize. Calculate whether you can comfortably afford housing costs and other expenses. Even if your mortgage is paid off, your property taxes will continue increasing — and are they worth it now that you’re retired and potentially don’t need as much space? Consider if the earnings from selling your current property can cover the costs of your new home and leave extra funds for other expenses as a nice retirement nest egg. Analyzing your financial situation and long-term financial goals will help you understand whether downsizing aligns with your financial wellbeing.

2. Lifestyle

Consider your activity level and whether you frequently entertain guests. Assess your space needs for hobbies and other activities. Also take this opportunity to consider if you really need as much space as you think you do — are you paying for and maintaining extra bedrooms you don’t need? Would you be able to enjoy a favorite hobby if you moved, like having more opportunities to fish if you moved closer to a lake?

3. Health

Can you effectively manage the maintenance and mobility requirements of a larger home? If you anticipate needing assistance with mobility or daily tasks in the future, a smaller home, especially one in a continuing care retirement community with healthcare and assisted living services, may be more suitable for your evolving needs.

4. Emotional Attachment

How attached are you to your current home? Are you willing to let go of memories and belongings? Remember that you’ll be giving up a lot more than just square footage if you move to a smaller home. Just know that leaving your home doesn’t erase those memories; it simply offers a new space to create future memories while potentially improving your physical and financial wellbeing.

5. Family Members

Consider your proximity to family members, especially if you have children or grandchildren living nearby. Maintaining these connections might be difficult if you move somewhere farther away. Meanwhile, if downsizing allows you to move closer to loved ones, this might make it a more attractive option.

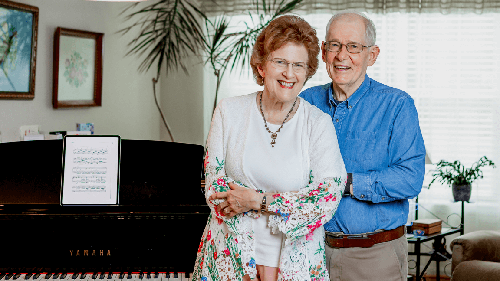

Should You Downsize to a Retirement Community?

If you’re leaning toward downsizing but want more than just a smaller house, retirement communities might check all your boxes. The good ones offer resort-style amenities including fitness centers, dining, hobby spaces, and more—plus support if your health needs change over time.

If you choose a continuing care retirement community like Acts Retirement-Life Communities, you also benefit from a phenomenal health services plan. Put simply, if you ever need a higher level of care such as assisted living or skilled nursing, you don’t have to move to a different facility. It’s all included on the same campus. With certain types of CCRC contracts, there’s also no increase in fees when you need a higher level of care. From the moment you move in, you can have a good sense of what budget you need for the next several decades.

Still Not Sure?

That’s totally normal. Downsizing is a big step, and you don’t have to rush into it. It might help to talk with a financial advisor or retirement planner to run the numbers and talk through your options.

Whether you stay, move to a smaller place, or join a community, the goal is simple: to live comfortably, safely, and happily in a home that supports your next chapter..

Ready to downsize for retirement? View downsizing tips for seniors or explore any of the 28 beautiful Acts Retirement-Life Communities throughout the East Coast.