Retiring and Moving to Another State: What to Expect

The allure of a new location can be especially enticing as you approach or relax deeper into retirement. A move might present the opportunity to live closer to family, find that dream climate, or perhaps discover a more affordable lifestyle to stretch your nest egg even further. If a change of scenery is on your retirement horizon, here's what you need to consider when retiring and moving to another state.

Factors to Evaluate Before You Relocate

- Taxes: Tax structures vary significantly across states. Some are retirement-friendly, boasting no state income tax, while others may tax pensions, Social Security benefits, or property more heavily. Do your research to understand the financial implications of where you might move.

- Cost of Living: States differ widely in overall cost of living, affecting your retirement budget. Housing, groceries, utilities and even transportation may be more affordable – or more expensive – than your current location.

- Climate: If escaping harsh winters or embracing warmer weather is a priority, climate will be key. Be sure to factor in humidity, potential extreme weather events, and how the climate might impact your favorite activities.

- Healthcare: Availability of quality healthcare and access to specialized medical facilities are vital – especially as you age. Research the quality of hospitals, physicians, and accessibility in potential locations.

- Lifestyle & Amenities: What matters most to you? Easy beach access? Mountain vistas? Vibrant arts scenes? Ensure your new location aligns with your recreational interests, cultural preferences, and overall lifestyle needs.

Popular Retirement Destination States: What They Offer

Now, let's explore a few popular choices for retirees looking to relocate, focusing on the specific benefits each state offers:

Alabama

Retirees looking for affordability and a warm climate will find much to love in Alabama. The state boasts beautiful beaches along the Gulf Coast, with opportunities for swimming, fishing, and boating. Those who prefer a more mountainous setting can find stunning scenery in the Appalachian Mountains in the northern part of the state. Many areas, from Mobile to Spanish Fort to the state capital, Montgomery, are steeped in history and offer a vibrant cultural scene.

Delaware

Beyond the beaches (which tend to be less crowded than those in neighboring states), Delaware offers retirees a tax-friendly haven. There's no sales tax, and Social Security benefits aren't taxed. The state is also known for its small-town charm and close-knit communities.

Florida

The Sunshine State remains a classic favorite of those retiring and moving to another state, and for good reason. Florida offers a warm climate year-round, with plenty of sunshine and opportunities for outdoor activities. The state boasts a wide range of retirement communities catering to diverse interests and budgets. Whether you dream of living on the beach, by a lake, or in a bustling city, Florida has something for everyone. And, of course, the family will always want to visit!

Maryland

History buffs and culture enthusiasts always find Maryland a compelling choice. The state is rich in colonial history, with Annapolis, the state capital, brimming with charm. Baltimore offers a vibrant arts scene, with world-class museums and theaters. Beyond the cultural offerings, Maryland boasts stunning mountain scenery in the west and a beautiful coastline along the Chesapeake Bay.

New Jersey

While New Jersey may have a higher cost of living than some Southern states, it offers retirees undeniable advantages. The state is home to excellent healthcare facilities and hospitals, providing peace of mind for those with specific medical needs. New Jersey's location also puts retirees within easy reach of all that New York City has to offer, from world-class museums and Broadway shows to iconic landmarks and a dynamic culinary scene, as well as close proximity to Philadelphia and Washington, D.C.

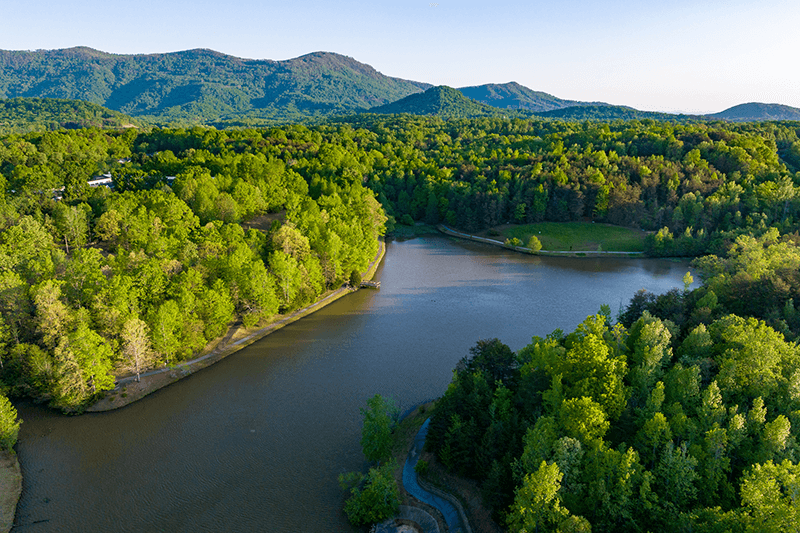

North Carolina

North Carolina entices retirees with its moderate climate, offering four distinct seasons without extreme temperatures, creating a perfect setting for the ideal retirement lifestyle. The state boasts a beautiful coastline with barrier islands and beaches, while the interior offers stunning mountain ranges and picturesque lakes. Culturally, North Carolina offers a blend of Southern charm and a growing metropolitan scene in cities like Charlotte and Raleigh.

Pennsylvania

Those seeking a taste of history and a lower cost of living than some Northeast states might find Pennsylvania appealing. The state is home to Philadelphia, a major city steeped in American history, and Gettysburg, a national park commemorating the pivotal Civil War battle. Pennsylvania offers retirees a choice between charming small towns, vibrant cities, and scenic countryside living.

South Carolina

Similar to its northern neighbor, South Carolina boasts a mild climate with warm winters and hot summers. The state is steeped in history, with Charleston offering cobblestone streets, historic architecture, and a charming Southern atmosphere. South Carolina's beautiful coastline offers abundant opportunities for enjoying water sports and relaxing on pristine beaches. The state also boasts a growing retirement population, creating a welcoming environment for new residents.

Making the Transition a Smooth One

As you prepare yourself for retirement and a possible move to another state, keep this advice in mind:

- Test it Out: Before committing to a move, vacation in your chosen location for a long weekend, or maybe even a week or more, to get a true feel for the area.

- Downsize & Declutter: Moving presents a perfect opportunity to streamline your belongings, making your new home feel more spacious.

- Stay Connected: Schedule regular visits with friends and family from your old location and utilize technology to maintain close social ties.

- Consider a CCRC: A continuing care retirement community will afford you true peace of mind; by ensuring you can budget for the next many years as you plan the costs of your ideal retirement lifestyle. This is because CCRCs include health services right on campus, and Type A options like those provided by Acts Retirement-Life Communities make it so any future needs are built into your existing costs, meaning you always know exactly how much you need to spend, even if you don’t always know what your needs will be.

Start Planning Your Future

While relocating can be exciting, it can also be a little daunting. Change brings a mix of emotions. Give yourself time to adjust, be patient with the process, and embrace all the new opportunities retirement in a different state can offer. Something else that can help? Talk to the retirement experts at Acts to get a true understanding of what an ideal retirement lifestyle in one of our lovely communities will look like and what you can expect. Or begin exploring any of our 28 communities all located somewhere sure to please.