When Should Seniors Sell Their Homes?

As you step into retirement (or if you’re already enjoying it) you may be wondering whether it’s time to sell your home. Maybe you're dreaming of downsizing to something more manageable, relocating to a warmer climate, or moving closer to loved ones. Or perhaps you're ready for a new lifestyle in a vibrant retirement community where you can enjoy hobbies, make new friends, and plan for the future.

So, the big question is: Is now the right time to sell? Let’s explore why the current housing market makes this moment especially appealing, and what your senior living options could look like afterward.

Why Selling Your Home NOW Makes Sense

If you’ve talked to friends, family, or neighbors lately, you’ve probably heard that the real estate market is hot—and they’re not wrong. Right now, low housing inventory and high buyer demand mean sellers are getting multiple offers, often above asking price. In some cases, homes are receiving offers before they even officially hit the market.

For many older adults, this creates a golden opportunity: Sell your home at top value, then downsize into a more affordable and easier-to-manage living space. Or explore senior housing options like a continuing care retirement community (CCRC) that doesn’t have costs impacted by a seller’s market.

Here’s what’s in your favor:

- Higher-than-average sale prices

- Quick sales thanks to strong demand

- The chance to unlock the equity you’ve built over time

The Benefits of Downsizing Now

Yes, selling your home means packing up and moving—but the benefits often far outweigh the hassle:

1. Increased Retirement Funds

If you’ve owned your home for years, it’s likely appreciated significantly. By downsizing, you can put that equity to good use, whether by boosting your retirement savings or paying for a more convenient lifestyle.

2. Lower Monthly Expenses

Downsizing means smaller spaces, fewer bills, and fewer maintenance worries. Moving to a retirement community, especially a CCRC, means your monthly costs could include everything from utilities to landscaping, all bundled into one predictable fee.

3. Enhanced Quality of Life

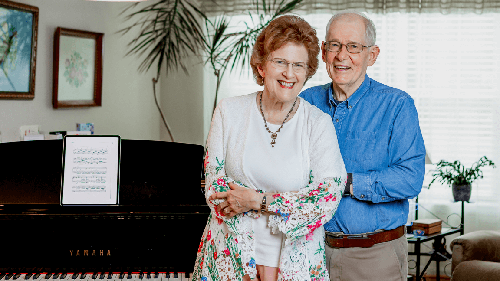

Communities like Acts Retirement-Life Communities offer amenities designed to enrich your retirement lifestyle:

- On-campus dining

- Fitness centers and pools

- Art studios and hobby rooms

- Social events and entertainment

- Healthcare services for future peace of mind

In other words, your money goes toward living well—not fixing a leaky roof or paying property taxes.

The True Cost of Staying Put

While keeping your home may feel like a safe option, it often comes with hidden costs:

- Ongoing maintenance and unexpected repairs

- Ever-increasing utility bills

- Property taxes, even if the mortgage is paid off

- Time and energy spent managing upkeep

- Relying on family for help with repairs and chores

And let’s not forget that as homes age, so do their systems. Plumbing, roofing, HVAC—all can become expensive burdens at a time when you’d rather spend your days enjoying retirement, not calling contractors.

So, When Should Seniors Sell Their Homes?

Timing your home sale is about more than the market—it’s also about your personal circumstances. Ask yourself:

- Do you need to sell your current home before buying your next one?

- Is your home move-in ready or does it need repairs first?

- Can you comfortably manage the move now, or would you rather do it before it gets harder physically?

While warmer months typically see more market activity, the current seller’s market makes right now an excellent time to act—especially if you’re planning to transition to a retirement living option like a CCRC. Then you get the benefit of selling high without the drawback of also needed to buy high.

What are Your Options After Selling?

After selling, you could:

- Buy a smaller home

- Rent in a 55+ community

- Move closer to family

- Or—perhaps the most comprehensive solution—transition to a continuing care retirement community

Why choose a CCRC like those offered by Acts Retirement-Life Communities?

- Stable Pricing: Acts’ rates are not tied to the housing market. Their Life Care plans offer predictable pricing—even as your care needs change.

- Built-In Healthcare: From independent living to assisted living to skilled nursing, everything is on campus.

- Freedom & Peace of Mind: No more home maintenance, no surprise bills, no moving again if your health changes.

Getting Started: How to Sell Your Home Smartly

Selling a home at any stage of life is a big decision, but the right support makes it easier. Partner with a real estate agent who understands the needs of older adults. They’ll help you:

- Price your home competitively

- Stage it to attract buyers

- Decide if pre-sale repairs are worth the investment

- Navigate offers, negotiations, and closing with ease

Acts communities even offer downsizing and moving assistance to make the transition smoother for future residents.

Make the Move that’s Right for You

Retirement should be about freedom, comfort, and enjoyment. Not yard work and rising costs. Selling your home and moving into a smaller space, especially within a continuing care retirement community, gives you the opportunity to focus on what matters most: making the most of this exciting new phase of life.

If you're ready to explore senior living options that prioritize your well-being, take a look at what Acts has to offer and find a campus that fits your future.