Page 9 - ActsAnnual Report 2018

P. 9

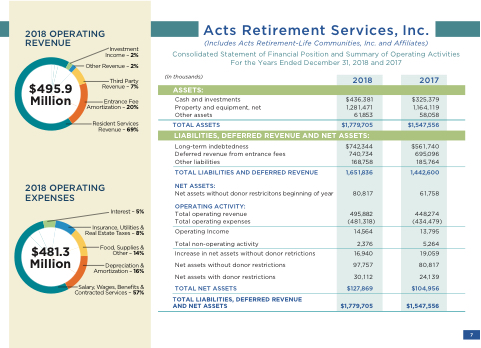

2018 OPERATING REVENUE

Investment Income – 2%

$495.9 Million

Other Revenue – 2% Third Party

2018 OPERATING EXPENSES

Revenue – 7% Entrance Fee

Amortization – 20% Resident Services

Revenue – 69%

Interest – 5% Insurance, Utilities &

$481.3 Million

Real Estate Taxes – 8% Food, Supplies &

Other – 14% Depreciation &

Amortization – 16%

Salary, Wages, Benefits & Contracted Services – 57%

ASSETS:

2018

$436,381 1,28 1,47 1 61,853

$1,779,705

2017

$325,379 1,164,119 58,058

$1,547,556

LIABILITIES, DEFERRED REVENUE AND NET ASSETS:

$742,344 740,734 168,758

1,65 1,836

80,817

495,882 (481,318)

1 4,564 2,376

16,940 97,757 30,112 $127,869

$1,779,705

$56 1 ,740 695,096 185,764

1,442,600

61,758

448,274 (434,479)

1 3,795 5,264

1 9,059 80,817 24,1 39

$104,956

$1,547,556

7

Acts Retirement Services, Inc.

(Includes Acts Retirement-Life Communities, Inc. and Affiliates)

Consolidated Statement of Financial Position and Summary of Operating Activities For the Years Ended December 31, 2018 and 2017

(In thousands)

Cash and investments Property and equipment, net Other assets

TOTAL ASSETS

Long-term indebtedness

Deferred revenue from entrance fees Other liabilities

TOTAL LIABILITIES AND DEFERRED REVENUE NET ASSETS:

Net assets without donor restricitons beginning of year

OPERATING ACTIVITY:

Total operating revenue Total operating expenses

Operating Income

Total non-operating activity

Increase in net assets without donor retrictions

Net assets without donor restrictions Net assets with donor restrictions TOTAL NET ASSETS

TOTAL LIABILITIES, DEFERRED REVENUE AND NET ASSETS