Retiring in 2025: Navigating New Horizons with Expert Trends, Tips, and Advice

Retirement is evolving quickly in the digital age, offering new opportunities and presenting unique challenges for those entering this exciting chapter of life. For individuals planning to retire in 2025, staying ahead of the curve is essential. Understanding the influence of economic, technological, and social trends can play a crucial role in shaping your retirement planning.

This guide will help you navigate these changes, offering valuable insights and practical advice for anyone who is retired or preparing to retire in 2025. Our mission is to empower you to plan for a fulfilling and secure future as you step into your golden years.

Understanding the Landscape for Retirement in 2025

Economic Trends Affecting Retirement

The retirement landscape in 2025 is significantly influenced by economic factors such as inflation and fluctuating interest rates. These elements can affect the purchasing power of your savings and the stability of your investments. Global economic trends, including market volatility and shifts in employment patterns, also play a crucial role in shaping retirement funds and pensions, emphasizing the need for strategic financial planning.

Technological Advancements

Technology is revolutionizing retirement planning and financial management. From sophisticated online platforms to mobile apps, digital tools are available to help retirees manage their savings, investments, and healthcare more efficiently than ever before. These advancements offer personalized advice, real-time monitoring of finances, and streamlined access to medical information, significantly enhancing the retirement experience in 2025.

Social and Demographic Shifts

Demographic changes, such as increased life expectancy, are altering traditional retirement models. There's a growing trend towards non-traditional retirement lifestyles, including community living, part-time work, and even continuing education. These shifts reflect a broader desire for more active, engaged, and purposeful retirements.

Planning for Retirement in 2025

Where is the Best Place to Retire in 2025?

Renowned for its tax-friendliness, warm climate, and vibrant retiree community, Florida remains a top choice for retirees seeking sunshine and relaxation. Other popular U.S. states include Alabama, North Carolina, and South Carolina.

International destinations are also gaining popularity among those planning to retire in 2025, as they offer an appealing lifestyle at a fraction of the cost. However, deciding on the best place to retire in 2025 requires careful consideration of various factors such as cost of living, tax-friendliness, healthcare facilities, climate, community, and recreational activities.

What Is the Best Month to Retire In 2025?

Choosing the best month to retire is a pivotal decision that can affect your financial health and overall retirement experience. In 2025, timing your retirement can be strategic, especially when considering tax implications, benefits, and personal circumstances. December is often selected as a favored month for retirement due to several reasons:

- Year-End Financial Planning: Retiring at the end of the year offers several advantages, such as maximizing your retirement contributions and fully utilizing employer-matched funds for that year. It also provides a clear cutoff for annual income, simplifying tax planning and ensuring you optimize your financial strategy.

- Maximizing Benefits: Waiting until year-end ensures you’ve accrued the maximum amount of vacation and sick leave, which could be paid out upon retirement, depending on your employer’s policies. This can provide an added financial cushion as you transition into retirement.

- Social Security Considerations: For those planning to start drawing Social Security benefits, the timing of retirement can affect your benefit amount. Depending on when birthdays fall, retiring later in 2025 might allow some to reach a full retirement age, thereby increasing their monthly benefit.

- Market Timing and Bonuses: By retiring after receiving year-end bonuses or other financial incentives, you can boost your retirement savings. Additionally, waiting until year-end provides the opportunity to assess financial market trends, which may help you optimize the timing of withdrawals from retirement accounts.

Of course, the "best" month is highly individual and depends on personal financial situations, health considerations, and lifestyle choices.

How Much Will You Need to Retire In 2025?

Calculating how much you'll need to retire in 2025 involves considering multiple factors, such as your lifestyle goals, expected healthcare expenses, inflation, and your planned retirement age. While a common guideline is to aim for a retirement savings amount equal to 25 times your annual expenses, the actual figure will depend on your unique circumstances and needs.

In 2025, financial experts generally recommend having a retirement fund that can replace 70-90% of your pre-retirement income. However, individual needs and goals vary, so personalized financial advice is invaluable in this planning stage.

Healthcare and Insurance

To ensure a worry-free retirement in 2025, it's crucial to understand your healthcare options, including Medicare, private insurance, and supplemental plans. Preparing for long-term care and exploring available insurance choices can help safeguard against future health-related financial challenges.

Tips for a Fulfilling Retirement

Staying Active and Connected

Embracing an active lifestyle through exercise, hobbies, and volunteering can greatly improve your overall health and well-being in retirement. Retiring in 2025 also brings exciting opportunities for lifelong learning and personal development, enriching your post-career life and keeping you engaged.

Nurturing Financial Well-Being

Maintaining financial health in retirement requires thoughtful budgeting and effective expense management. Regularly revisiting your financial plan, safeguarding your credit score, and managing debts responsibly are essential steps toward ensuring long-term financial security and peace of mind.

Social Connectivity and Mental Health

Building and maintaining social connections are essential for a happy retirement, helping to prevent loneliness and promote mental well-being. Engaging in community activities, pursuing hobbies with others, and leveraging mental health resources can support a balanced and fulfilling retirement.

How to Navigate the Challenges and Uncertainties of Retirement in 2025

Preparing for potential challenges, such as financial insecurity or health issues, is an integral part of retirement planning. Staying adaptable, informed, and proactive in managing these uncertainties can help you navigate the complexities of retirement smoothly.

Step into Your Best Years!

Retiring in 2025 offers a blend of challenges and opportunities. By staying informed about the latest trends, planning strategically, and embracing a proactive approach to retirement, you can ensure a fulfilling and secure future. We invite you to share your thoughts, plans, and questions about retiring in 2025, joining a community of like-minded individuals looking forward to their golden years with optimism and excitement.

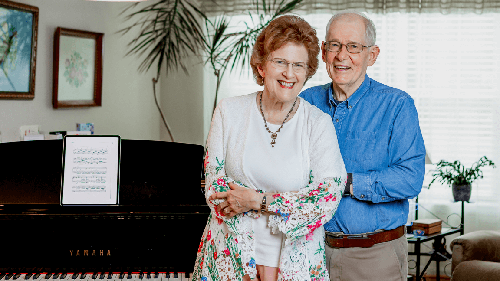

If you are planning to retire in 2025, consider exploring the possibility of settling at an Acts Retirement campus near you, where you can find a supportive and engaging environment tailored to your lifestyle preferences. For more tips on retirement planning, Acts offers a Consumer's Guide to Retirement Living, to help you make an informed decision about your options. Stay informed and empowered as you embark on this exciting journey into retirement.

What to read next?

If you'd like more information on retiring, consider reading: